A 7,000 billion dollar secret, the Swiss banking industry holds a third of all global offshore assets, ring-fenced by ingrained conservatism and strict banking secrecy laws.

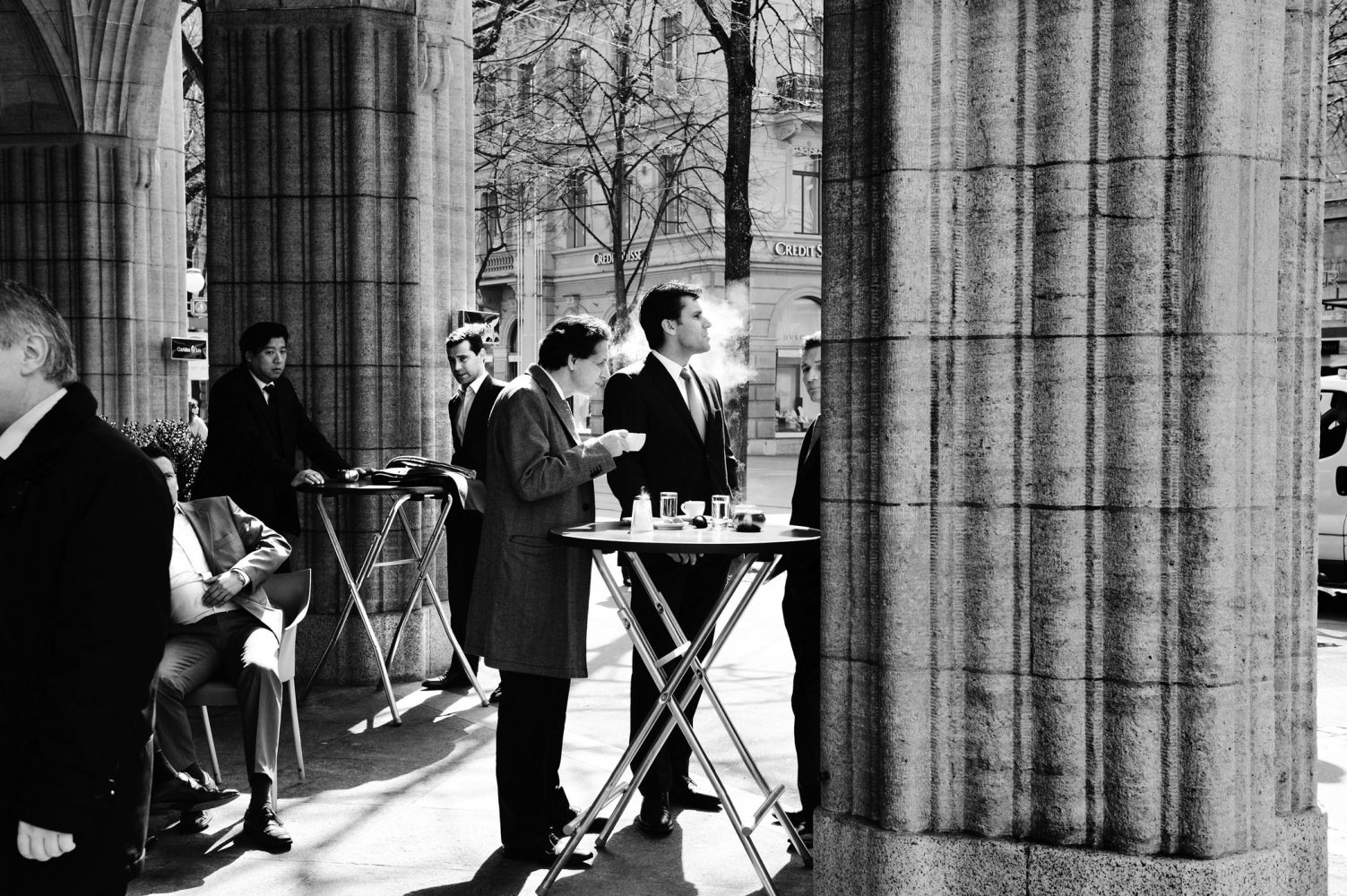

Accounting for half of the Swiss banking industry, two banks – UBS, and Credit Suisse – dominate the austere heart of this secretive world. Headquartered side by side on Paradeplatz in Zurich, they’re said to own vast vaults beneath the square, containing gold, cash and enough secrets from around the world to feed myriad spy novels and thrillers.

MHE09147SWI

The Swiss flag flies on the roof of luxury hotel Savoy Baur en Ville, overlooking Paradeplatz, the symbolic centre of the Swiss banking industry, showing the headquarters of Switzerland's two largest banks, UBS and Credit Suisse.

Swiss banks have long been accused of sheltering the cash of dictators, despots, gangsters and arms dealers and recent revelations also point to wealthy Americans and Europeans, eager to avoid taxes.

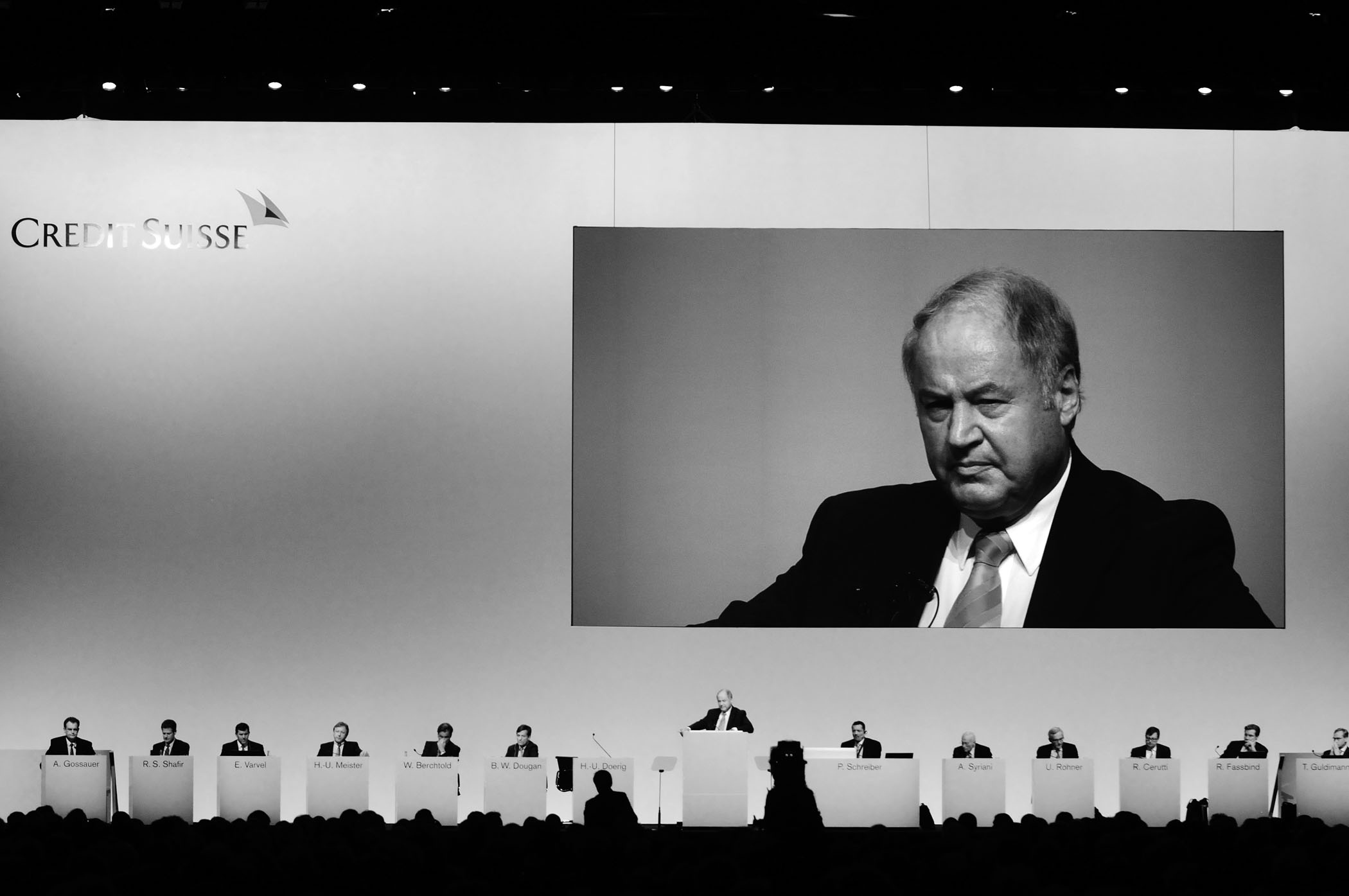

UBS was caught red-handed, using secret codes and encrypted computers to encourage Americans to do just that in 2008. Credit Suisse, meanwhile, is under investigation by the IRS for other forms of subterfuge, while smaller private banking outfits have banned their employees from travelling to the US for fear of arrest.

Some Swiss call this clampdown on the banks an ‘economic war’. Others, including many politicians and even shareholders, are disenchanted with the apparent arrogance, incompetence and venality exposed by recent losses, scandals and giant bonus payments. The tectonic plates are shifting under the banks.

Calls are widespread for greater supervision and tighter regulation. Even the hallowed banking secrecy law itself is under threat, with the Swiss government agreeing to the handover of the names of 4450 US account holders to the IRS in the wake of the UBS scandal. Dictators at the wrong end of revolutions are also finding their assets suddenly frozen, out of reach when they need them most.

The recent US2.3 billion loss at UBS caused by a single employee in its London offices, and the precipitate resignation of the bank’s CEO Oswald Grubel, has pushed the secretive world of Swiss banking further into an uncomfortable spotlight, and done little to improve its reputation.

The recent US2.3 billion loss at UBS caused by a single employee in its London offices, and the precipitate resignation of the bank’s CEO Oswald Grubel, has pushed the secretive world of Swiss banking further into an uncomfortable spotlight, and done little to improve its reputation.